Configure AI Intelligent Arbitrage System

Help you get rid of the risk of loss and achieve stable investment returns.

While markets panic, AI keeps earning. Learn how institutional-grade AI arbitrage turns volatility into steady profit. Join the Funding Arbitrage Bot WhatsApp Group and start your learning journey today.

Join the Official WhatsApp Group

Join the Official WhatsApp Group

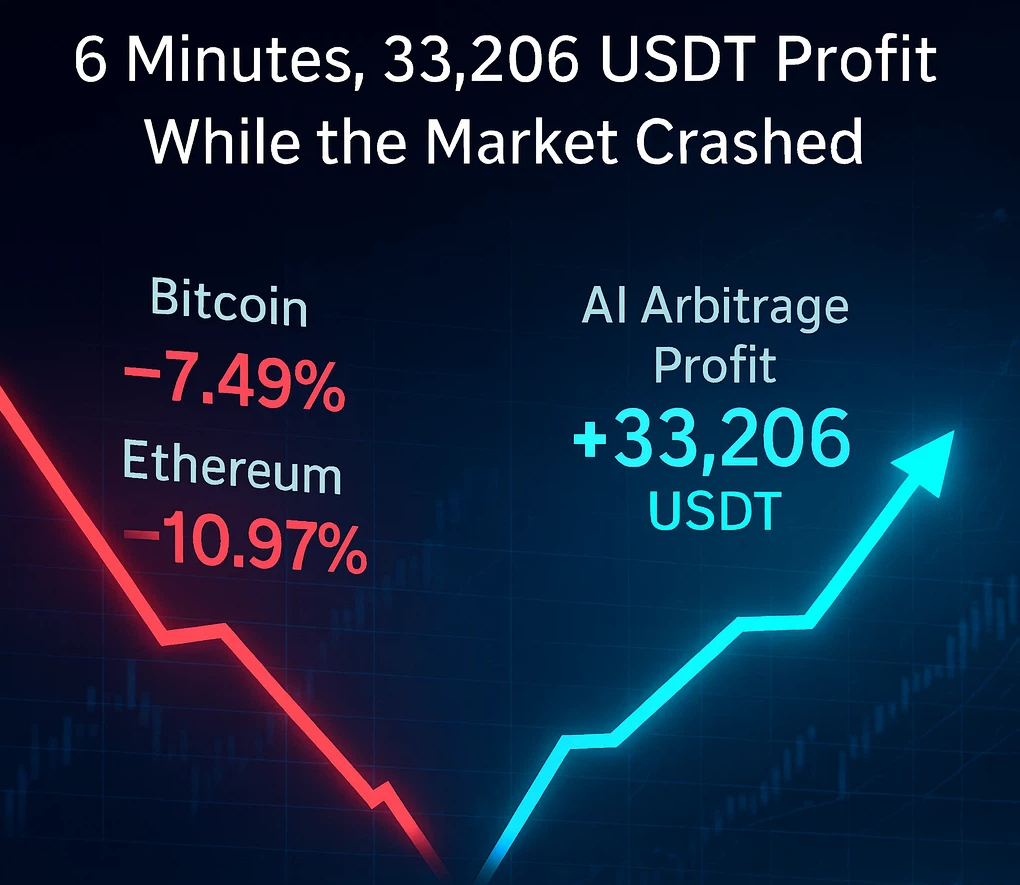

On October 10, Donald Trump’s sudden tariff threat on China sent global crypto markets into freefall.

- 📉 Bitcoin dropped 7.49%

- 📉 Ethereum plunged 10.97%

- 📉 Dogecoin collapsed 21.63%

Human traders panicked — billions were wiped out overnight.

But while others lost, our AI Institutional VIP Arbitrage Model quietly generated stable profits.

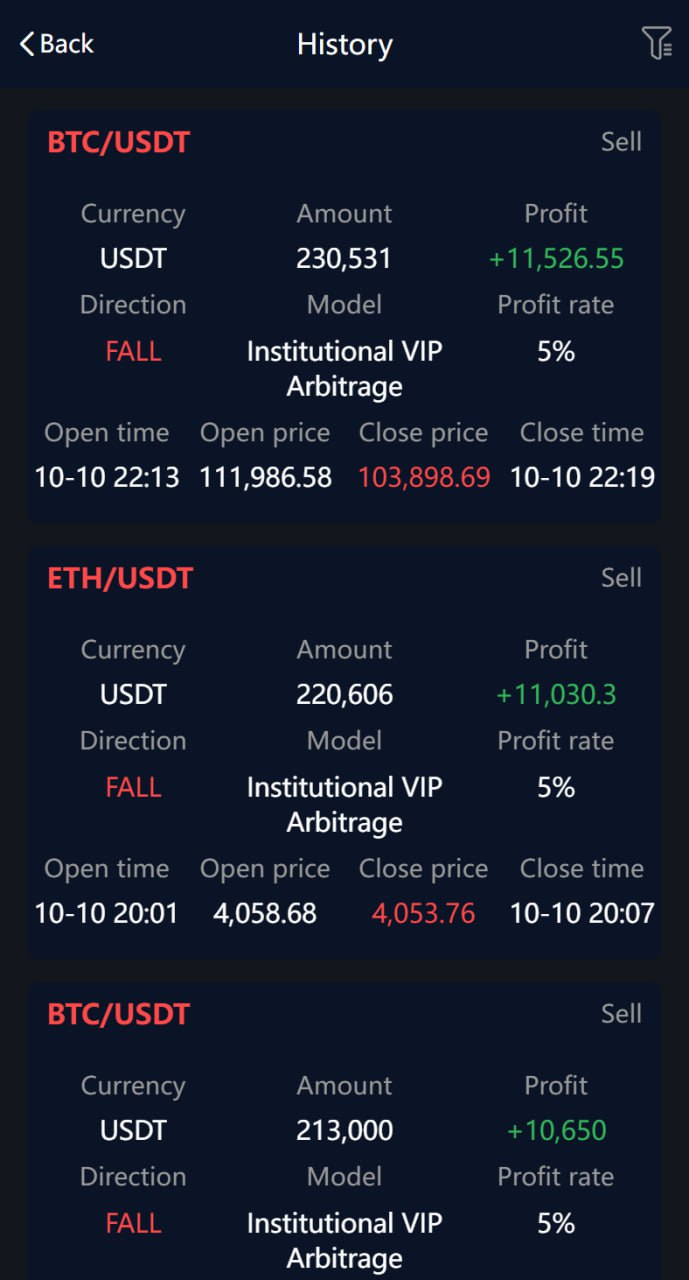

AI Institutional VIP Arbitrage Trades

During the October 10 market crash, the AI system executed three precise arbitrage trades in just 6 minutes, earning a total profit of 33,206.85 USDT.

6 Minutes • 33,206 USDT Profit — While the Market Crashed !!!

In just minutes, the AI model detected price inefficiencies, executed short arbitrage across BTC and ETH pairs, and captured profit — while the market was crashing.

Emotion loses money. Algorithms don’t.

Profit Models Overview

Choose Your AI Arbitrage Model — From beginner-friendly short cycles to institutional-grade compounding models, all powered by AI.

Why AI Arbitrage Wins

- ✅ Market-neutral strategy — profits in all conditions

- ✅ 24/7 automated trading

- ✅ No human emotion, no insider risk

- ✅ Transparent, verified results

Real Investors, Real Profits

Sarah W. — London, UK

“During the crash, my manual trades lost 8%. My AI bot gained +27% in 3 days.”

Kenji S. — Tokyo, Japan

“I started with 3,000 USDT in the Elite Model and made +900 USDT profit in one 5-day cycle — even while Bitcoin was down.”

Maria L. — Madrid, Spain

“Finally a system that makes money whether the market goes up or down. Transparent. Stable. 100% automated.”

Institutional Strategy • Personal Access

The same market-neutral arbitrage methods used by institutional trading desks are now accessible to verified users.

Our algorithms continuously monitor funding rate differentials between exchanges — generating safe, predictable yield regardless of price direction.

Mathematics beats emotion.

Automation beats fear.

Meet the Expert Team

Our global arbitrage research team combines quantitative modeling, financial strategy, and AI system design — ensuring continuous optimization and reliable returns.

Bell Charlotte

Investment Advisor — France

MSc Finance, HEC Paris. Specialist in fund management & global wealth strategy.

Prof. Jean Pascal Rey

AI Arbitrage Expert — Switzerland

Professor of AI, ETH Zurich. Researcher in algorithmic arbitrage and quantitative modeling.

Sachiko Nishikawa

Group Assistant — Japan

BA Economics, University of Tokyo. Expert in community operations & cross-cultural communication.

📢 Join the AI-powered arbitrage learning group immediately!

Gain direct access to:

- • Live profit updates & model breakdowns

- • Professional team teaching and sharing AI arbitrage tutorials

- • Free trial opportunities for new members

Join Now → [Official WhatsApp Group]

Join Now → [Official WhatsApp Group]

Funding Arbitrage Bot is a market-neutral, AI-powered arbitrage system that profits from cross-exchange inefficiencies and funding rate differentials. Past performance does not guarantee future results.